extended child tax credit calculator

This money was authorized by the American Rescue. The enhanced Child Tax Credit was signed by President Joe Biden in March as part of the American Rescue Plan.

Child Tax Credit Reduced Usage Of High Cost Financial Services The Source Washington University In St Louis

Government disbursed more than 15 billion of monthly child tax credit payments in July to American families.

. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. These payments were part of the American Rescue Plan a 19 trillion dollar. Tax Changes and Key Amounts for the 2022 Tax Year.

You can use this calculator to see what child and family benefits you may be able to get and how much your payments may be. Your amount changes based on the age of your children. The credit was increased from 2000 to up to 3600 per child for each child under 6.

The payment for children. Its a much bigger credit for potential taxpayers in tax year 2021. How many can I claim.

Child tax credit. Parents with higher incomes also have two phase-out schemes to worry about for 2021. The monthly installments will end.

30003600 child tax credit. Families could qualify for up to 3000 per child between ages 6 and 17 and 3600 per child under 6 and receive half of the sum before actually filing their taxes. Last year the Child Tax Credit got a number of key enhancements.

The expanded Child Tax Credit would be extended for 2022 and pay qualifying families 300 monthly for each child under age six and 250 for each child between ages six and 17. The first one applies to the extra credit amount added to. Making the credit fully refundable.

Enter your information on Schedule 8812 Form 1040. Without further congressional action the child tax credit will revert back to 2000. Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid.

But the changes werent permanent. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022.

Millions of families across the US will be receiving their. The payments for the CCB young child supplement are not reflected in this calculation. Included in President Joe Bidens American Rescue Plan the 19tn coronavirus relief package is an extended child tax credit for.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. Here is some important information to understand about this years Child Tax Credit. The Earned Income Tax Credit would also get extended to 2022 and pay up to 6728 depending on tax filing status annual income and number of children.

Estimate your 2021 Child Tax Credit Monthly Payment. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000. Enter the number of qualifying dependents between the ages 6 and 17 age as of Dec.

To reconcile advance payments on your 2021 return. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. First its value was boosted to a 3000 maximum for children aged 6 to 17 and a 3600 maximum for children under the age of 6.

Tax credits calculator - GOVUK. How much is the child tax credit worth. The Child Tax Credit provides money to support American families.

Enhanced credit could be extended through 2025. 31 2021 for Tax Year 2021. Child and family benefits calculator.

In 2021 and 2022 the average family will receive 5086 in coronavirus stimulus money thanks to the expanded child tax credit. The Motley Fool. Enter the number of qualifying dependents aged 5 or younger age as of December 31 2021 for Tax Year 2021 including dependents or children born during 2021.

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line. Congress fails to renew the advance Child Tax Credit. Get your advance payments total and number of qualifying children in your online account.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Child Tax Credit Schedule 8812 H R Block

Top Tax Refund Calculators In 2022 To Estimate Irs Payments With New Child Tax Credit

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

How To Calculate Taxable Income H R Block

Ppf Calculator With Extension Check Ppf Extension Returns In 3 Quick Easy Steps In 2021 Safe Investments Public Provident Fund Tax Free Savings

September Child Tax Credit Payment How Much Should Your Family Get Cnet

Aca Penalty Calculator Health Insurance Coverage Employment Full Time Equivalent

Try The Child Tax Credit Calculator For 2021 2022

Income Tax Calculator Estimate Your Refund In Seconds For Free

Tax Calculator Income Tax Tax Preparation Tax Brackets

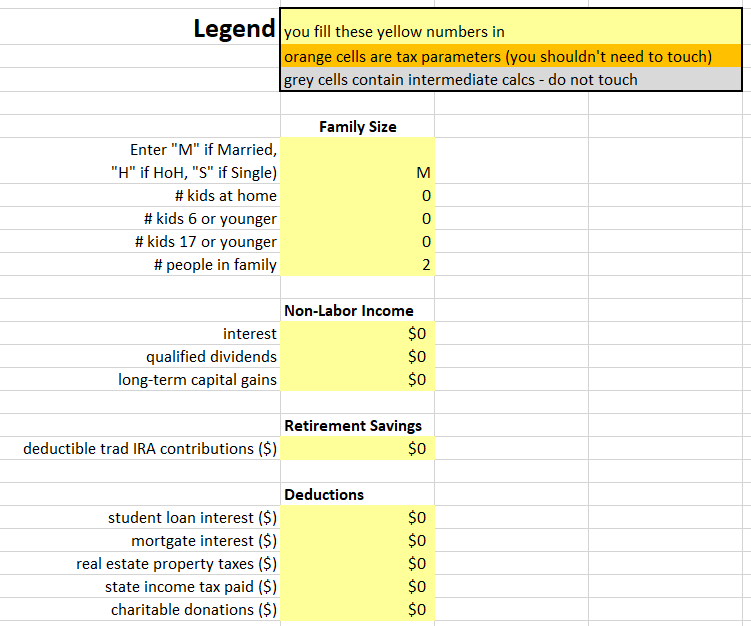

2021 Tax Calculator Frugal Professor

2021 Tax Calculator Frugal Professor

Explore Our Image Of Monthly Spending Budget Template For Free Budgeting Worksheets Budget Template Worksheet Template

Tax Credit Definition How To Claim It

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

2021 Child Tax Credit Calculator Internal Revenue Code Simplified

2021 Child Tax Credit What It Is How Much Who Qualifies Ally